Your taxes are finally filed. Whether you ultimately owed more or received a refund, it’s hard not to notice how much from your paychecks over the last year went to the federal government. But what exactly happens to those dollars? Can you meaningfully recognize whether they’re actually helping you, your neighbors, and your local community?

Where Do These Dollars Go?

Certainly, the federal government spends taxes to help Americans in several important ways, especially through deep investments in social security, health insurance, and national defense. But aside from these large government spending items, federal tax dollars can work another way: by granting investment money in local government programs.

Federal grant programs provide resources to help people, businesses, and local governments overcome a range of common obstacles. Take the Edward Byrne Memorial Justice Assistance Grant (also known as “Byrne JAG”) – the largest federal grant program dedicated to supporting innovative criminal justice programs across the country.

When people think about government investments in criminal justice, they tend to think about more police or prosecutors. But there are many other ways that we can improve public safety and the functioning of our criminal justice system altogether.

Investing in Return-to-Court Solutions

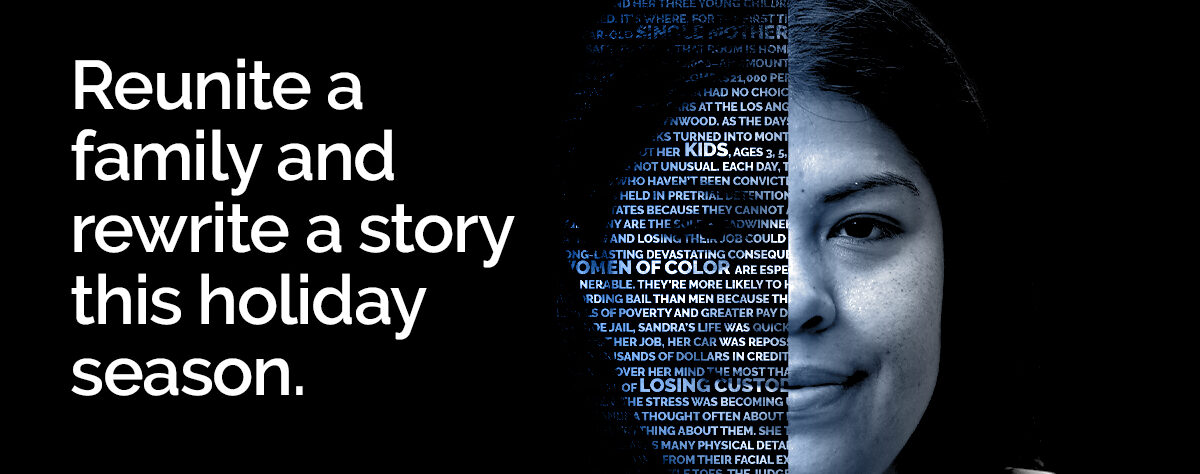

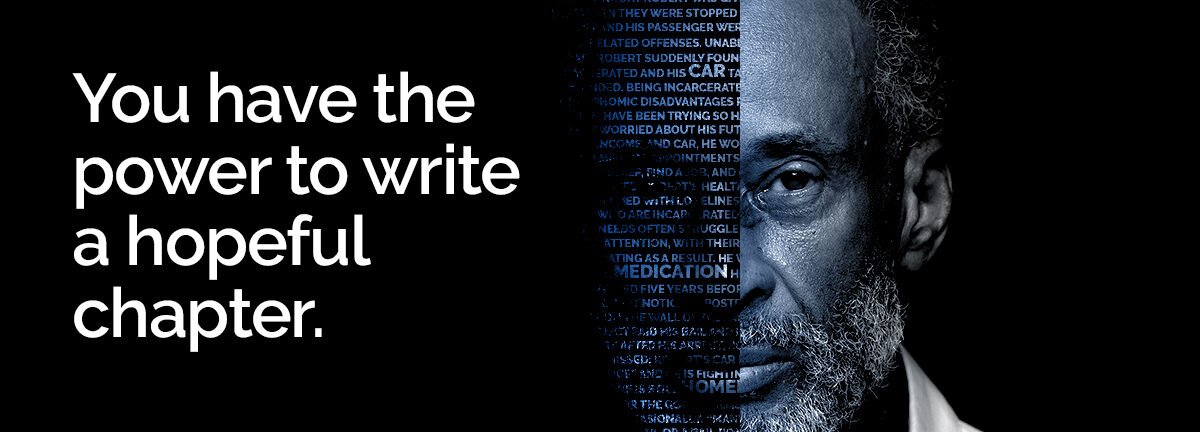

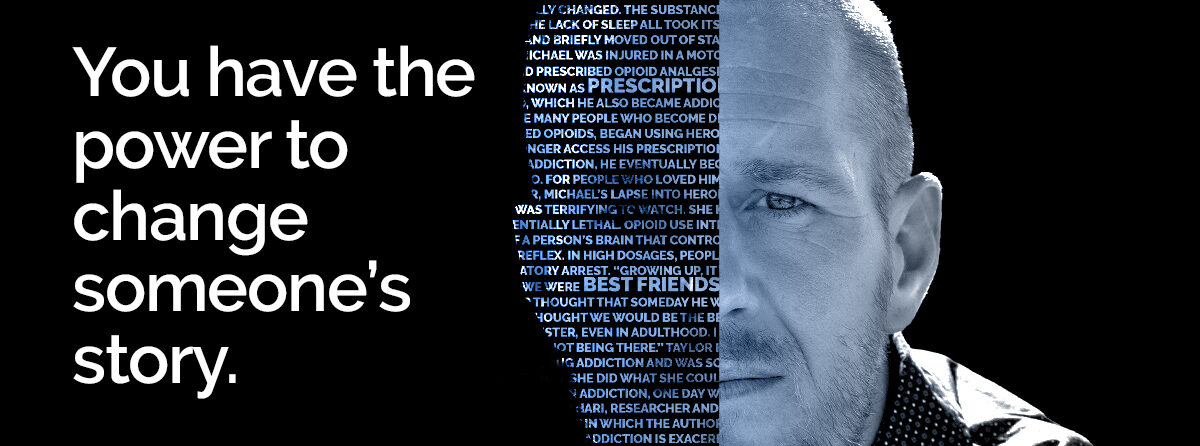

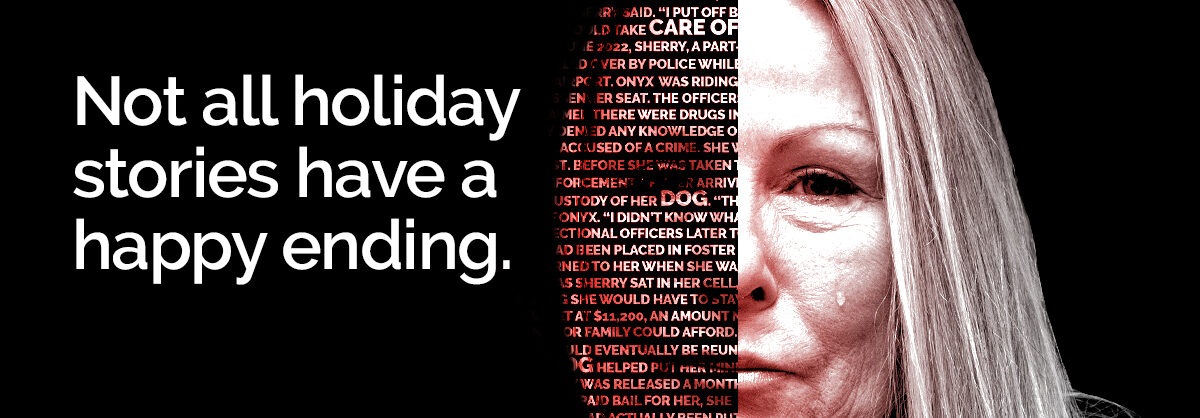

While not the most glaringly obvious problem for Byrne JAG to focus on, low return-to-court rates come at a high cost. Even one missed court date due to everyday challenges such as a lack of transportation, often results in pretrial detention for months or even years. This time in jail disrupts legally innocent people’s lives while costing taxpayers $14 billion annually.

Investing in simple solutions to improve how often people make it to court can avoid these costs. The Bail Project’s Community Release with Support model proves the efficacy of return-to-court services such as text reminders, transportation assistance, and access to voluntary supportive services like employment assistance, housing support, and mental health and substance use treatment. We have provided pretrial support for more than 30,000 low-income individuals nationwide using this support model. The result: our clients have returned to 91% of their court dates, saving over $92 million in tax dollars.

The Bail Project’s model demonstrates that court return services can significantly improve pretrial outcomes – saving jurisdictions in the long term. Unfortunately, governments have historically underfunded these interventions. The initial cost of implementing these services may seem daunting, but counties and cities don’t need to foot the bill solely through their local budgets.

How to Help

With federal grant programs like Byrne JAG readily available each year, taxpayers must lift their voices up. All it takes are a few steps:

- Find out if your local government provides any return-to-court services, and which they don’t (and encourage them to establish robust support!).

- Share resources on how effective The Bail Project’s model is.

- Ask your mayor, city or county council members, and local judges to apply for Byrne JAG and other federal grants to help fund the set up of court notification and transportation systems.

With hundreds of thousands of people awaiting trial each year, resources are needed now more than ever. Putting our tax dollars to good use back inside our own communities will create fairer, safer, and more equitable pretrial systems.

Thank you for reading and your willingness to engage in a complicated and urgent issue. In addition to providing immediate relief by offering bail assistance, we at The Bail Project are working to advance systemic change. Policy change doesn’t happen without the support of people like you. If you found value in this article, please consider taking action today by donating.